Table Of Content

These plans generally only cover losses related to fire, smoke, lightning, windstorms, explosions, and vandalism. To replicate their homeowners insurance coverage, most California residents pair their CA FAIR Plan with a difference in conditions policy that essentially covers everything that the former doesn’t. The average cost of homeowners insurance in California is $115 per month or $1,383 per year for $300,000 in dwelling coverage, according to our latest insurance pricing analysis. Once you know the average home rebuild cost in your area, you can multiply this figure by the square footage of your home.

Do You Want to Save by Choosing a Higher Deductible?

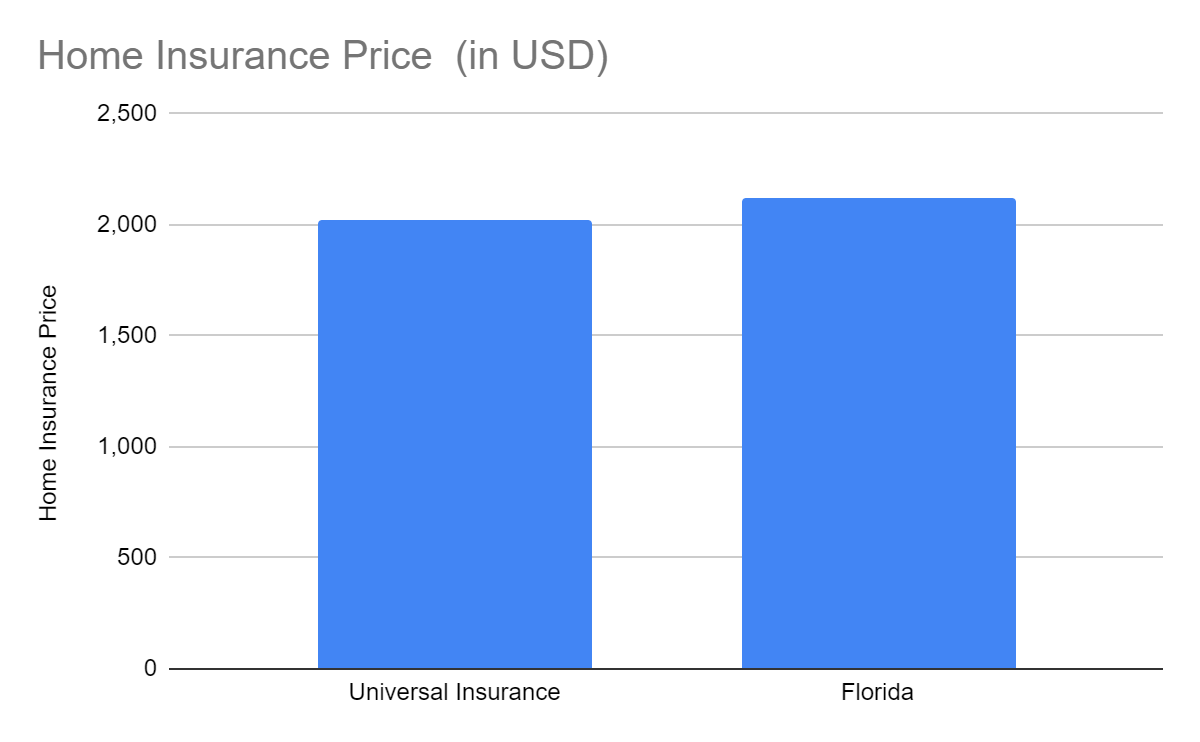

To help you compare the best home insurance quotes from Policygenius, our team of home insurance experts gave each of the largest home insurance companies in the U.S. by market share a Policygenius rating. For an additional cost, you may have the option to upgrade your personal property coverage to replacement cost to ensure depreciation isn't subtracted from personal property claim payouts. If you’re shopping for California home insurance, rates have a sizable difference from one home insurance company to another. Before buying, shopping with multiple companies will help you find the right coverage at the best price for your needs. Across Florida, homeowners are dealing with costly insurance policies at a time when many have lost trust in their carriers after many dropped the ball on claims dealing with Hurricane Ian damage. Across the state, homeowners have complained about skyrocketing premiums and the loss of coverage as large insurance companies abandon policyholders.

Get Free Homeowners Insurance Quotes

The average cost of homeowners insurance in California is $1,250 per year, or about $104 per month. We include rates from every locale in the country where coverage is offered and data is available. When comparing rates for different coverage amounts and backgrounds, we change only one variable at a time, so you can easily see how each factor affects pricing. Wildfires have likely surpassed earthquakes as the disaster California homeowners should be most concerned about. With fire season in California lasting months on end, it's getting increasingly difficult for homeowners in wildfire-prone areas to find coverage due to the increased risk of expensive claims. In addition to looking at how much each insurance company charges for different coverage levels and risks, you should also be aware of what your policy does and doesn’t cover.

The crippling home insurance crisis hitting America - Financial Times

The crippling home insurance crisis hitting America.

Posted: Mon, 29 Apr 2024 04:00:12 GMT [source]

What are the five cheapest states for homeowners insurance?

Here are some steps homeowners can take to make home insurance more affordable and accessible. The average increase over two years for each state is based on 27,156 total policy renewals between May 20, 2021 and May 20, 2023. Lisa McArdle is an insurance editor who joined the Bankrate team in 2023. She has more than 15 years of experience writing, editing and managing content in a variety of industries, including insurance, auto news and pop culture. Nearly all of our top picks for the best home insurance companies have complaint levels that are below the industry average.

How California fares in 20 national rankings, from housing to crypto to wellness

The first thing you may notice, besides the differing premiums, is the different dwelling coverage amounts. Because each home insurance company uses its own valuation tool to determine the rebuilding cost of a home, it’s common to get quotes for slightly different dwelling amounts from different companies. Because many other home insurance coverage types default to a percentage of the dwelling amount, these coverage limits also vary between the quotes. A home insurance quote is an estimate of how much you’ll pay for a policy based on details about your home, credit score, claims history, and coverage limits.

Here’s the average annual home insurance rate for five different levels of dwelling coverage. For a quick and accurate estimate, use our homeowners insurance cost calculator. All you need to do is provide a few brief details about your home — including its address, square footage, and year built — and we’ll send you homeowners insurance estimates from multiple insurance companies. If you rent your home, you may want a renters insurance policy, which covers your belongings and also includes essential coverage types such as liability, medical payments to others and additional living expenses. A landlord’s insurance will cover damage to the building (but it won’t cover your personal items). Yes, it’s worth your time to compare quotes even if you already have homeowners insurance.

If you need more than a $500,000 liability limit, a separate umbrella policy may provide additional coverage. Each company uses a proprietary underwriting algorithm that weighs your underwriting characteristics differently (your ZIP code, loss history and roof age, for example). The offers that appear on this site are from companies that compensate us.

She mentioned raising rates based on the cost of reinsurance, or insurance for insurers. With an average increase of 47% from May 2021 to May 2023, the average home insurance premium has skyrocketed in New Mexico over the last two years, according to our findings. In the last year alone, insurance premiums on the policies we analyzed increased an average of 22%.

How Much Is Homeowners Insurance? Average April 2024 Rates - NerdWallet

How Much Is Homeowners Insurance? Average April 2024 Rates.

Posted: Mon, 01 Apr 2024 07:00:00 GMT [source]

Personal property

Every home is different, which means insurance companies rate each home on a case-by-case basis. Your home’s specific characteristics will play a role in determining how much you pay for homeowners insurance. For both home and auto insurance, carriers usually place shoppers who are married or in a recognized domestic partnership in a lower-risk group. You may want to shop early, and end your old policy on the same date your new one starts to avoid a lapse in coverage. A coverage lapse could leave you and your home financially vulnerable and could raise your rates.

The average home insurance premium in the U.S. is $1,754 per year, according to a 2023 Policygenius analysis of home insurance premiums in every U.S. state and ZIP code. Increasing your policy deductible, bundling your home and auto insurance with a single company, and adding protective devices to your home like storm shutters and security systems can all get you lower premiums. Get Forbes Advisor’s ratings of the best insurance companies and helpful information on how to find the best travel, auto, home, health, life, pet, and small business coverage for your needs. A home insurance quote is a free estimate of how much you will pay for a home insurance policy. Your home is likely one of your biggest investments, so it makes sense to protect that investment with the best homeowners insurance policy you can buy.

It's up to you to weigh these costs up and decide which option suits you better. We don't ask about driving other cars in our list of optional extras when you get a quote. If the car doesn't have insurance, you must keep it off the road and get a Statutory Off Road Notification (SORN). If you can't find your certificate of motor insurance, it might be listed under your last renewal letter. No, you can’t drive other cars if you have third party or third-party, fire and theft insurance. If you have DOC on your policy, you might be able to drive someone else's car in an emergency.

For example, a visitor slips down your steps on a rainy day and gets injured. Personal Property coverage protects belongings that were damaged or stolen such as furniture, appliances, clothing, and electronics. Our Personal Property Insurance calculator can help you decide how much coverage fits your situation. Below are some of the most asked questions about homeowners insurance. Check our home insurance FAQ and home insurance resources page for more information.

Like Allstate, State Farm also boasts an impressive, nationwide network of agents. Additionally, State Farm’s average premium for homeowners insurance is on par with the national average. Bankrate's insurance editorial team, which includes licensed agents, has compiled information worth considering when shopping for home insurance quotes. Our industry expertise, combined with our analysis of average rate data from Quadrant Information Services, might help you understand the process of comparing home insurance quotes. Our goal is to streamline your shopping to help you find the best coverage for your needs.